Post-Omnibus: What sustainability leaders should do next in 2026

For sustainability, finance, and executive leaders, the key question is no longer what might change, but what should we do now.

The answer depends on whether your organization remains in scope of CSRD, has fallen out of scope, or is preparing for future applicability. What has not changed is the growing expectation that sustainability data is credible, decision-useful, and aligned with how businesses manage risk, opportunity, and capital.

2026 is shaping up to be a transition year. Not a pause, and not a compliance sprint, but a strategic reset.

What the Omnibus decision actually changed

The Omnibus agreement confirmed several structural shifts that materially affect how companies approach sustainability reporting.

A narrower mandatory scope

Far fewer companies will now be legally required to report under CSRD. Large EU companies meeting higher employee and turnover thresholds, as well as certain non-EU companies with significant EU activity, remain in scope. Many mid-sized companies will no longer face a direct legal obligation.

Simplified ESRS

The European Commission has mandated the development of simplified ESRS, with adoption expected by mid-2026. These standards reduce data points significantly and introduce additional reliefs and phase-ins.

For in-scope companies, simplified ESRS will be the applicable reporting framework from financial year 2027, with an option to apply voluntarily in 2026.

Formal recognition of voluntary pathways

The Omnibus clarified the role of the VSME standard as a proportionate reporting option for companies outside CSRD scope. This gives out-of-scope companies a formal, structured baseline for sustainability reporting that allows them to speak in the same common compliance language as their in-scope peers. However, many businesses out of scope are continuing to pursue ESRS to ensure wholesale compatibility with their market and to enhance the strategic oversight they have on their data.

These changes matter. They reduce complexity and remove immediate compliance pressure for many organizations. But they do not remove expectations.

What the Omnibus did not change

One of the most important takeaways from the Omnibus discussions is what stayed the same.

Sustainability data is still required by the market

Banks, investors, large corporate customers, and public buyers continue to need structured sustainability information to meet their own regulatory, risk management, and disclosure obligations.

In practice, this means many companies that are now out of CSRD scope will still be asked for data that closely resembles ESRS disclosures, particularly on climate, governance, and supply chains.

Climate and financial risk remain central

Simplification does not reduce scrutiny on climate risks, transition exposure, or financial effects. If anything, attention becomes more concentrated on fewer, higher-quality disclosures.

Value chain pressure continues

Large in-scope companies still need consistent sustainability information from suppliers. That pressure has not disappeared. It has simply become more targeted.

The Omnibus reduced regulatory complexity. It did not redefine what “good” sustainability management looks like.

If you are still in scope: 2026 as a strategic reset year

For companies that remain in scope of CSRD, 2026 should not be treated as a waiting year. It is a window to move from compliance readiness to strategic integration.

Use simplified ESRS to refocus, not to scale back

Simplified ESRS reduces volume, but it does not remove the need for judgment, prioritization, or governance. The opportunity in 2026 is to refocus effort on what matters most rather than reproducing broad, unfocused disclosures.

Reframe the double materiality assessment (DMA)

Double materiality should evolve from a documentation exercise into a management tool. Leading companies are using it to:

- Identify financially relevant sustainability risks

- Inform enterprise risk management

- Guide investment and transition decisions

This is particularly important as sustainability risks increasingly intersect with financial planning and long-term value creation.

Strengthen climate and financial effects analysis

Climate remains a focal point for regulators, banks, and investors. Simplification does not lower expectations around understanding transition risks, physical risks, and financial effects. It raises the bar on quality.

Integrate sustainability into existing processes

2026 is an opportunity to embed sustainability into finance, procurement, operations, and governance structures, rather than treating it as a parallel reporting function.

If you are out of scope: choose structure, not opting out

Many companies are now formally out of CSRD scope. This changes the nature of the conversation, but not its relevance.

The key question for 2026 is not whether to engage with sustainability frameworks, but how.

Use reporting frameworks as a shared language

Frameworks like ESRS and VSME provide a common structure that allows companies to communicate consistently with customers, lenders, and partners who are still reporting.

Even partial alignment can significantly reduce friction in value chain requests and commercial discussions.

Decide deliberately between VSME and ESRS elements

For some companies, VSME will provide sufficient structure. For others, especially those operating in regulated sectors or supplying large corporates, selectively aligning with simplified ESRS may offer strategic advantages. Companies with more than 250 or 500 employees may realize that the VSME does not satisfy their reporting and communications needs.

The goal is not to report more, but to report in a way that matches stakeholder expectations.

Focus on decision-useful information

Out-of-scope companies should prioritize the sustainability topics that recur in:

- Tenders and RFPs

- Partnership discussions

This typically includes climate, governance, and supply chain risks.

Why 2026 matters regardless of scope

A recurring theme in the Omnibus discussions is that compliance pressure has eased, but expectations have not.

This creates a narrow but valuable window to:

- Build internal capabilities without deadline pressure

- Improve data quality and governance

- Align sustainability with financial and strategic decision-making

- Prepare for future regulatory and market shifts

Sustainability regulation has never been static. Companies that treat 2026 as a pause risk falling behind when expectations tighten again.

Common mistakes companies are already making

As organizations react to the Omnibus outcome, several patterns are emerging.

Treating simplification as a stop signal: Reducing reporting effort too aggressively can erode internal capability and credibility at exactly the wrong moment.

Dismantling sustainability governance too early: Even out-of-scope companies benefit from clear ownership, processes, and data discipline.

Underestimating value chain expectations: Many suppliers assume that customers will reduce sustainability demands. In practice, those demands are becoming more focused, not weaker.

Losing momentum internally: Pausing sustainability work entirely in 2026 makes it harder to restart later and increases long-term cost and effort.

Practical next steps for 2026

For in-scope companies

- Revisit your double materiality assessment with a strategic lens

- Prioritize climate, financial effects, and supply chain risks

- Align sustainability governance with finance and risk functions

- Prepare systems and controls for simplified ESRS reporting

For out-of-scope companies

- Clarify what sustainability data customers and banks require

- Choose a proportionate reporting structure using VSME or selected ESRS disclosures

- Use sustainability frameworks to assess risks and opportunities internally

- Build consistency and credibility, even where reporting is voluntary

From regulatory relief to strategic sustainability

The Omnibus has reduced complexity, but it has also shifted responsibility back to companies to decide how sustainability information is used.

For both in-scope and out-of-scope organizations, 2026 is less about producing reports and more about making sustainability legible, credible, and useful for decision-makers.

Those who use this year to move from compliance-driven activity to strategic sustainability will be better positioned for what comes next.

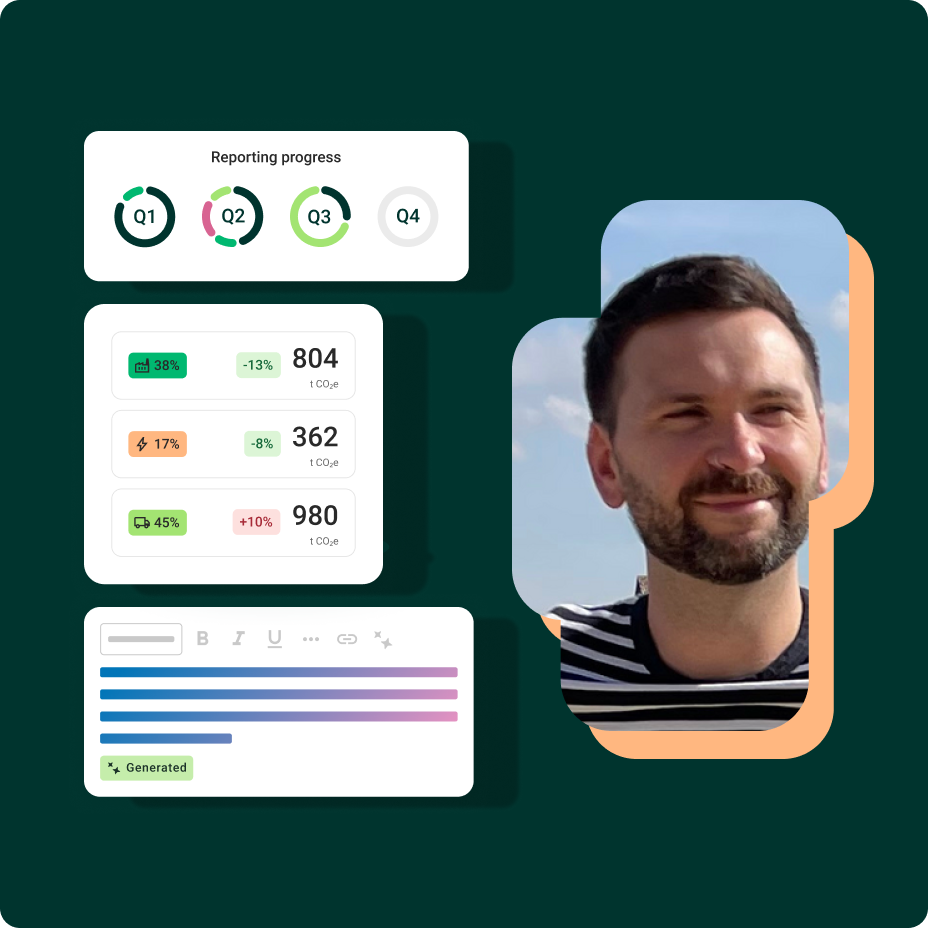

Chat with us

Regitze Theill Jensen

Director, Benelux

Position Green