Insights from DNB: How banks assess sustainability for business loans

For corporate leaders, this has practical consequences. Sustainability information now affects how companies are assessed in credit processes, portfolio reviews, and long-term financing discussions. This is true regardless of whether a company is formally in scope of CSRD.

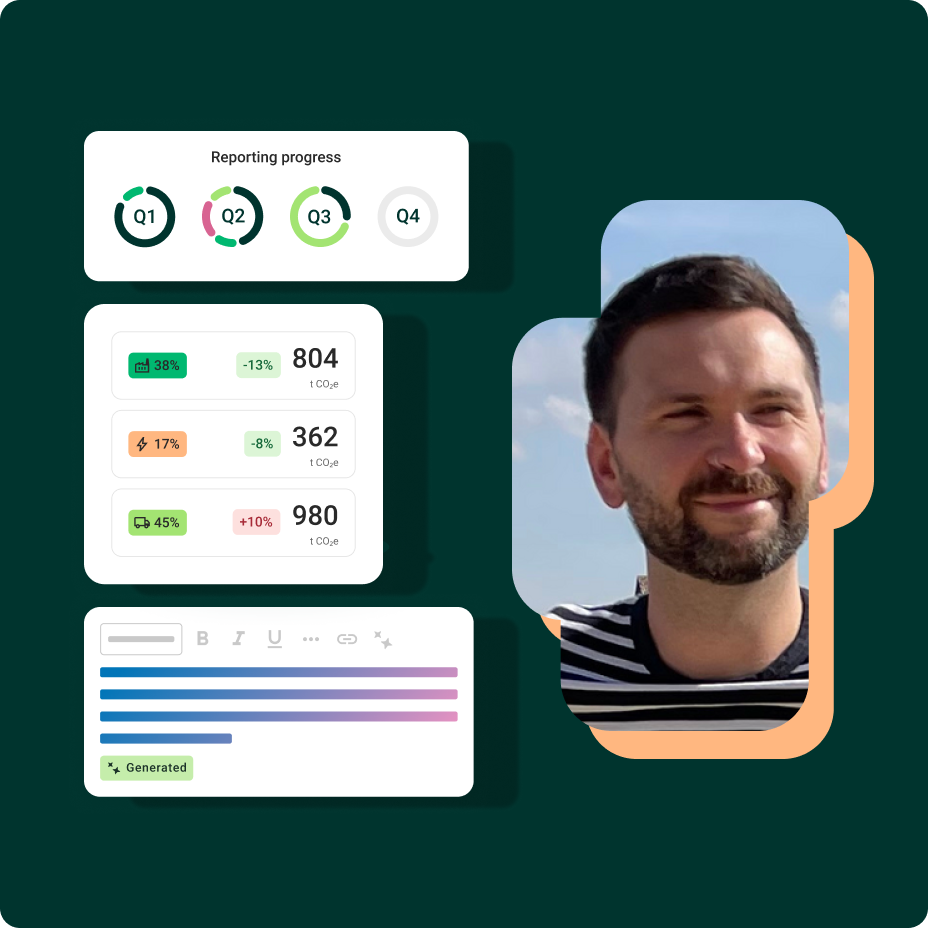

To better understand how these expectations are applied in practice, Position Green spoke with Hilde Nordbø, EVP Group Sustainability at DNB, Norway’s largest bank. Her perspective reflects a broader shift across the financial sector that companies need to factor into their corporate and financing strategies.

Sustainability as an input to core banking risk management

One of the most important shifts in recent years is that sustainability considerations are no longer treated as a parallel ESG topic inside banks. They are increasingly integrated into existing risk management structures.

This shift is not optional. It is driven by supervisory expectations that require banks to assess how environmental, social, and governance factors affect credit risk, long-term exposure, and portfolio stability.

“In January 2025, the EBA, the European Banking Authority, came out with ESG guidelines for how the banks are to integrate ESG risk into our general overall risk management.”

Hilde Nordbø, EVP Group Sustainability, DNB

Hilde further highlights: “And they mentioned a lot of processes within the bank that we have to integrate E, S, and G issues into.”

Once sustainability factors are embedded in risk frameworks, they naturally influence a wide range of banking activities. These include credit assessments, client reviews, stress testing, and portfolio-level analysis. Sustainability information is therefore no longer evaluated only for reputational reasons, but as part of how banks form a view on business resilience.

From ESG questionnaires to baseline expectations

Many companies still experience sustainability requirements as fragmented or inconsistent. A questionnaire from one bank, a data request from another, and different expectations across markets.

What is changing is not the existence of these requests, but their function. Sustainability information is becoming a baseline input to ordinary banking processes rather than a separate layer of engagement.

This does not mean that banks are introducing entirely new requirements overnight. Rather, sustainability considerations are being absorbed into existing assessments of creditworthiness and long-term viability. Over time, this will likely make sustainability readiness harder to distinguish from general business readiness.

Think of sustainability, therefore, as an added layer of your competitive advantage, both in demonstrating that you have assessed the risks and exposure of your organization (and likely further than peers who haven’t), as well as underscoring your key advantages, too. Now, let’s take a look at what banks like DNB assess as part of reviewing your sustainable efforts.

What banks actually evaluate when they assess sustainability

A common misconception is that banks are primarily focused on classifying companies as green or non-green. In practice, this framing is too simplistic to support meaningful risk assessment.

Banks are increasingly interested in whether a company understands its exposure, acknowledges possible constraints, and has a credible approach to managing transition risks over time. Sustainability information becomes relevant when it helps answer those questions.

This approach matters particularly for companies in sectors facing significant transition pressures. The assessment is less about alignment with an end-state today and more about trajectory, governance, and execution capacity. But what is crucial to note here is that this is becoming a part of a broader, general process for any assessment. ESG might be the yardstick, but the methodology behind it is all about determining how competitive your business is.

Why sustainability data requests persist even as regulation changes

Recent regulatory simplification has led some companies to assume that sustainability data demands will diminish. From a banking perspective, this assumption does not hold.

Banks continue to need sustainability information to understand portfolio-level risk and meet their own regulatory obligations. This can create a structural mismatch between regulatory thresholds and market expectations.

Even where companies fall outside CSRD scope, banks may still need information on emissions, governance, or transition exposure to complete their assessments. As a result, sustainability data requests are becoming more focused, more risk-driven, and more closely linked to financing discussions.ions, faster, without compromising credibility. than a scoreboard: it becomes a practical tool for value creation.

The role of ESRS and CSRD beyond compliance

Frameworks such as ESRS and CSRD are often viewed primarily as regulatory burdens. From a banking perspective, their value lies elsewhere.

Standardized frameworks help create a common language between companies and financial institutions. They improve comparability, reduce ambiguity, and make it easier to understand how sustainability risks and opportunities are identified and managed.

Hilde states: “The intention of CSRD and ESRS, in terms of standardizing and forcing companies to be concrete on the impact of their business, is very good. But there has definitely been a need to simplify as well. Reporting should reflect what you do, and we need more focus on quality rather than quantity. ”

This does not mean that all companies need to report in full under these frameworks. But understanding their logic and structure can make sustainability discussions with banks and investors more efficient and more credible. Consider it as a common language your bank is using to compare sustainability between their clients, rather than as a laundry list of requirements you need to fulfill before you can secure a green loan.

This isn’t to say that pursuing CSRD for its own sake does not come with a host of advantages, but better than that, you’re pursuing your own sustainability with the added value of collating your impact in a way banks can trust.

Strategic priorities for companies engaging with banks and investors

As sustainability expectations continue to evolve, companies benefit from focusing on a small number of priorities that consistently matter in financing discussions.

First, sustainability information should be connected to how the business is run. Data that is isolated from strategy, governance, or financial planning is harder for banks to use and easier to discount.

Second, credibility matters more than breadth. Banks are more interested in realistic assessments and clear trade-offs than in comprehensive but generic disclosures.

Third, sustainability data should be consistent over time. Frequent changes in scope, methodology, or narrative make it harder to assess progress and increase perceived risk.

Finally, companies should assume that sustainability discussions with banks will continue to deepen, even if formal reporting obligations change. As such, it is much more advantageous to see your sustainability strategy as a living process rather than as a series of must-do regulatory exercises.

A durable shift in how sustainability is assessed

The sustainability requirements of banks and investors are not driven by temporary regulatory trends. They reflect a deeper shift in how financial institutions understand long-term value, resilience, and risk.

For companies, sustainability information is increasingly judged by the same standards as financial information: relevance, consistency, and decision-usefulness.

Those that treat sustainability as an integral part of how the business is managed will be better positioned in financing discussions than those that approach it as a reporting obligation alone.

But for most businesses, the most common challenge of all of this is understanding where to start, especially when they are no longer in scope. That’s where Position Green can support.

Our blending of sustainability management software and in-house advisory expertise put you in the driver’s seat of your own ambition. We merge an understanding of the core sustainability activities that drive the best strategic yield alongside your specific compliance needs to ensure your impact is high, and your time spent on due diligence is low.

Chat with us