How to link your double materiality assessment to strategy

Now comes the harder and more valuable part. How do you make that DMA useful? How do you connect what you have learned to strategy, budgets, product roadmaps and decision-making?

With new ESRS updates expected in 2026, sustainability leaders who treat the DMA as a static, one-off exercise risk falling behind. The next advantage lies in linking your DMA to strategy, turning insight into action, compliance into growth, and governance into business resilience.

Why linking your DMA to strategy creates value

A DMA is not just a reporting tool. It is a strategic map. The topics you have identified as material represent the most significant levers of value creation and risk reduction in your organisation.

When used well, your DMA helps you:

- Focus investment on issues with measurable impact on enterprise value

- Align leadership around sustainability priorities backed by evidence

- Translate ESG language into financial and operational terms the board understands

- Anticipate regulation and stakeholder shifts before they become crises

- Demonstrate progress and authenticity to investors, employees and customers

Your DMA can become the operating system for sustainable strategy, but only if it is integrated into how the company plans, measures and governs performance.

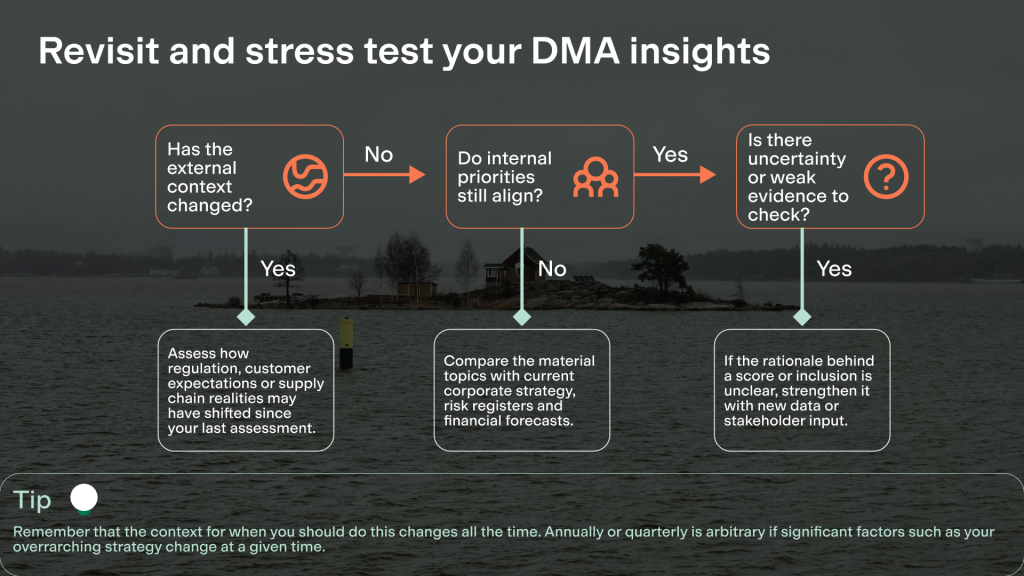

Step 1 – Revisit and stress test your DMA insights

Begin by revisiting your existing DMA findings, not to redo them, but to ensure they still hold strategic weight.

Ask three questions:

- Where is there uncertainty or weak evidence? If the rationale behind a score or inclusion is unclear, strengthen it with new data or stakeholder input.

- Has the external context changed? Regulation, customer expectations or supply chain realities may have shifted since your last assessment.

- Do internal priorities still align? Compare the material topics with current corporate strategy, risk registers and financial forecasts.

This stress test phase should refine your DMA from a compliance snapshot into a living strategic reference.

Step 2 – Translate DMA topics into business priorities

Every material topic represents a decision point. The key is to connect each one to strategic objectives and financial outcomes.

| Material topic | Strategic implication | Business opportunity |

| Climate transition | Rising energy and input costs | Accelerate efficiency and renewables programmes |

| Supply chain human rights | Reputational and procurement risk | Supplier engagement and brand trust |

| Product circularity | Regulatory pressure and customer demand | New product lines and closed-loop models |

To operationalise this:

- Group topics under your main strategic pillars such as growth, cost, risk and innovation

- Define objectives and KPIs for each pillar that reflect DMA insights

- Prioritise initiatives by both impact potential and strategic alignment

When done right, sustainability becomes a filter for business focus, not an add-on.

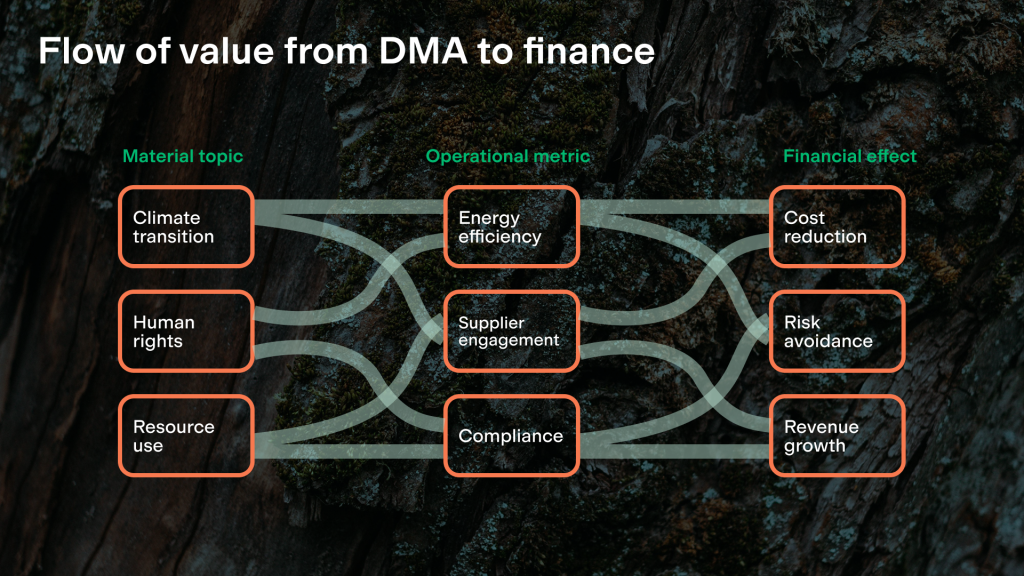

Step 3 – Quantify financial linkages and value creation

Boards and CFOs increasingly expect a financial narrative behind sustainability priorities. Your DMA provides the evidence base to quantify value drivers.

For each material topic, map:

- Revenue linkage: percentage of tenders requiring low-carbon solutions or potential customer churn from ESG misalignment

- Cost linkage: energy intensity, waste disposal fees, supplier efficiency

- Risk avoidance: regulatory fines, insurance premiums, supply disruption

- Capital access: lower cost of capital from sustainability-linked finance

Where possible, express value as risk-adjusted financial exposure or opportunity size. This reframes sustainability as capital allocation, not cost.

A practical tool here is the value driver tree, a visual chain from ESG metric to operational outcome to financial effect.

Step 4 – Embed your DMA in corporate planning cycles

Your DMA insights should inform the same rhythm as your strategic and financial planning.

- Budget cycle: integrate DMA-linked initiatives into capex and opex plans

- Enterprise risk management: include top ESG risks and opportunities in the corporate risk register

- Product development: link material topics such as biodiversity or circularity to innovation pipelines

- Procurement: tie supplier evaluations to DMA-identified hotspots

A simple way to institutionalize this is to make each material topic owned by a function such as Finance, Operations, HR or Product. The sustainability team becomes the integrator, not the doer.

Step 5 – Set measurable targets and KPIs

Once DMA topics are linked to strategy, define targets that bridge ESG and financial language.

Here are a few examples of how this can be presented:

- Reduce Scope 1 and 2 emissions 42 percent by 2030, supporting cost efficiency and risk reduction

- Achieve 80 percent of revenue from products with verified sustainability claims by 2028, supporting growth

- Audit 100 percent of suppliers under social criteria by 2027, supporting brand resilience and compliance

Make sure KPIs are quantifiable, based on traceable data sources, and time-bound within planning horizons. This allows your sustainability dashboard to stand alongside your financial dashboard with equal credibility.

Step 6 – Design governance that keeps your DMA alive

The biggest failure mode for DMAs is letting them go stale. Treat your DMA as a strategic intelligence system that evolves continuously.

Effective governance practices include:

- A quarterly materiality pulse to scan new regulations, investor questions and stakeholder feedback

- Trigger events such as new market entries, acquisitions or regulatory shifts that prompt reassessment

- Clear ownership of each material topic by a business leader accountable for data and progress

- Cross-functional forums where DMA results are reviewed by the risk committee, executive team and board

This ensures your DMA remains aligned with the business environment, not an outdated matrix filed away after reporting season.

Step 7 – Use your DMA to drive innovation and opportunity

The most mature organisations use DMA insights not only to manage risk but also to create value.

- Product innovation: high-impact topics often reveal unmet market needs, such as low-carbon materials or circular services

- Customer differentiation: use DMA insights in sales and marketing to strengthen tenders or justify premium pricing

- Partnerships: identify where your material issues overlap with suppliers’ or customers’ priorities and collaborate on shared goals

A well-integrated DMA acts as a strategy catalyst, revealing where sustainability can unlock growth, efficiency and reputation.

Step 8 – Communicate your DMA-driven strategy

Transparency converts credibility into trust. Communicate not only what your DMA found but how it shapes your decisions.

Internal communication

- Integrate DMA insights into leadership scorecards and town hall updates

- Link employee objectives to DMA-aligned KPIs such as procurement staff measured on supplier sustainability ratings

External communication

- In disclosures, explain how DMA findings led to specific strategic initiatives

- Use clear visuals like value-driver maps and impact–financial matrices to make the narrative tangible

- For investors, connect DMA outcomes directly to risk management and growth metrics

Done well, communication demonstrates that sustainability is embedded, not decorative. A good rule of thumb to think about this is the following: It is beneficial for all companies to become more energy efficient, however, it is going to be more materially-impactful for a transportation or freight organization to reduce their fossil fuel usage than a software company.

By the same token, a software company would benefit more from reducing their reliance on data centers or non-cloud architecture, where a freight company might only see marginal returns. The ability to explain this process of prioritization demonstrates what material topics you have measured, how you have measured them, and crucially why you measured them as well.

Step 9 – Stay adaptable amid regulatory change

ESRS updates in 2026 will refine methodologies and expectations for double materiality. Rather than racing to comply early, build a flexible system that can adapt quickly.

- Document your current methodology clearly so updates can be made transparently

- Maintain traceable evidence and rationale for each topic to simplify reassessment

- Keep a living methodology note that evolves alongside ESRS guidance

- Future-proofing your DMA ensures it continues to inform strategy regardless of regulatory shifts.

Quick takeaways

- Most companies have already completed their DMA. The opportunity now is to use it as a strategic engine

- Revisit and test insights regularly so your DMA evolves with the business context

- Link material topics directly to objectives, KPIs and budgets

- Quantify the financial implications of sustainability performance

- Embed DMA outputs into governance, risk and planning

- Use the findings to drive innovation and competitive advantage

- Communicate clearly how DMA insights inform business strategy and performance.

Conclusion

Your double materiality assessment was never meant to be the end product. It is the starting point for strategy. The companies that will lead in the next phase of CSRD reporting are those that connect their DMA to business planning, innovation and value creation.

That requires a mindset shift from compliance project to decision-making framework. The good news is that you already have the foundation. Your DMA tells you where your most significant risks and opportunities lie.

The challenge now is to embed those insights into every corner of your organization, keep them alive through governance and review, and let them guide how you create sustainable, long-term value.

Want to turn your DMA into a strategic engine?

Explore how Position Green helps companies connect their material topics to targets, KPIs and strategic outcomes.

Maja Bjuggstam

Senior Associate

Position Green