FAQ: The Omnibus process and how it affects your reporting now

Our experts have summarized and clarified the 16 most frequently asked questions to help you understand what’s changing, what remains uncertain, and how your company can move forward with confidence.

1. What are the new CSRD thresholds and are they confirmed?

As of mid-November, 2025, the EU has signalled major shifts in its sustainability regulatory landscape: it proposes to raise CSRD thresholds to 1,750 FTEx and €450 million in turnover, which would place roughly 92% of companies out of scope. It also seeks to scrap climate transition plan requirements entirely, remove EU-wide CSDDD civil liability provisions and delete the review clause, and introduce a risk-based approach with limits on data requests to suppliers under Article 8. In addition, the proposal would allow member states to set their own penalties, eliminating the previous 5% turnover benchmark.

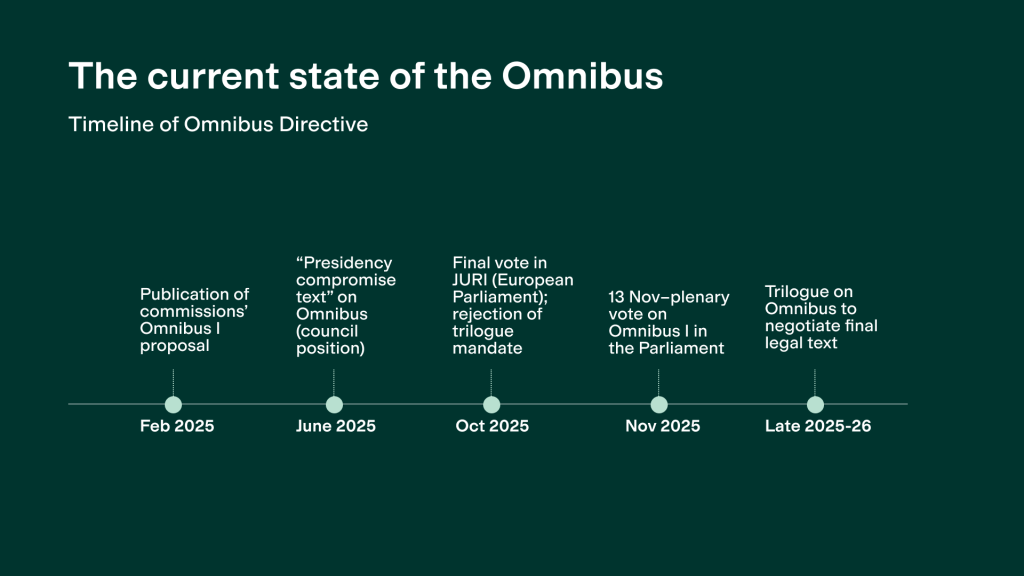

2. When will the Omnibus decision take effect?

Once the European Parliament adopts its position on the Omnibus, trilogue negotiations, where the three EU institutions will seek a political agreement, will follow. The adoption of the final legal text is expected at the end of 2025 or in early 2026, and reporting obligations for newly scoped-in companies would then apply from FY2027.

3. How do the Omnibus changes affect reporting timelines for different company waves?

Wave 1 companies, which began reporting for FY 2024, will continue to report for FY2025. Wave 2 companies, originally expected to start with FY2025, will likely move to FY2027 under the Omnibus. The extension aims to give companies more time to prepare under the revised ESRS framework.

4. Does the Omnibus affect publicly listed companies?

Yes. Listed companies will still be required to report under the CSRD, but only if they meet the criteria for large companies which are about to be redefined. Small and medium-sized listed entities are likely to fall out of the scope of the CSRD.

5. Could these thresholds change again in the future?

The thresholds are not formally confirmed yet, so changes to the current compromise texts may still occur. However, even after the revision process is done, they could technically be revised in the future. The revision would require a new legislative process. In practice, though, the current thresholds, once official, are expected to remain in place for the foreseeable future.

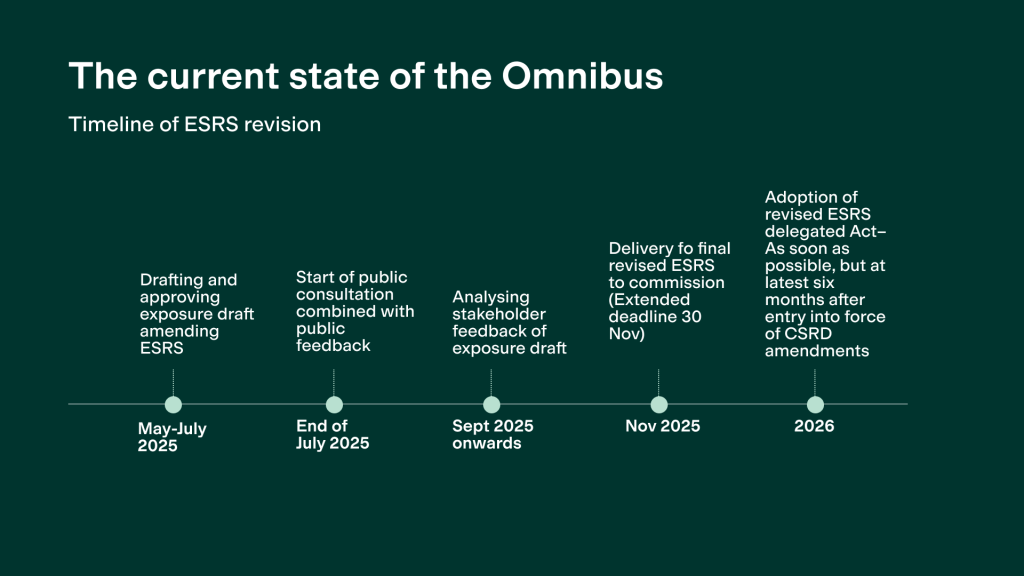

6. What’s the current status of the simplified ESRS and when will it apply?

EFRAG, the institution advising the European Commission on financial and non-financial reporting, is finalizing the simplified ESRS, with delivery to the European Commission expected by 30 November 2025, followed by a public presentation on 4 December. Formal adoption is expected in 2026, as the process depends on the adoption of the Omnibus proposals.

Therefore, the current expectation is that companies could use the revised standards for FY2027 reporting, unless EU institutions decide to give companies the choice to apply them earlier in draft versions.

7. Are the “Quick Fix” measures for Wave 1 reporters confirmed?

Yes. The Quick Fix adjustments, including phased-in reporting for ESRS E4 and S2 disclosures, are adopted in practice and will apply for FY2025 reporting. The only remaining step is formal publication in the EU’s Official Journal, which is expected shortly.

8. How does the Omnibus process interact with the ESRS revisions?

The two processes run in parallel. The Omnibus determines the overarching framework legislation, including scope and timing, determining which companies must report and when. The ESRS revision led by EFRAG focuses on simplifying the reporting requirements. Both processes complement one other.

9. How will non-EU companies be affected?

Non-EU companies with significant operations or turnover in the EU will still face indirect obligations. Companies with subsidiaries or branches that fall in the scope of the Directive will have to report accordingly. Even if not legally required to report, many will need to provide sustainability data to EU partners or align with ISSB-based or CSRD-inspired frameworks to stay competitive.

Non-EU companies would fall under the scope of the CSRD if they meet the following criteria:

- Generate annual EU revenues surpassing €450 million, with an EU branch annual net turnover of €50 million

- Generate annual EU revenues exceeding €450 million and own an EU subsidiary considered a large company, meeting the following criteria: more than 1000 EU-based employees and revenue exceeding €450 million.

10. What will happen to the Voluntary SME (VSME) standard, and how does it affect the value chain?

The VSME standard will remain voluntary and largely unchanged for now. It may later evolve into a formal voluntary regulation, but for now it offers a practical framework for SMEs that want to align with sustainability expectations from larger partners and investors, even if they are not legally required to report.

At the same time, the VSME acts as a “value chain cap,” meaning that companies reporting under the CSRD cannot demand sustainability information from smaller partners beyond what is included in the VSME, although the inclusion of additional sectoral data to better understand sustainability issues that are common in an undertaking’s sector is appropriate. This approach helps maintain proportionality and prevents excessive data burdens for SMEs.

11. Do subsidiaries have to report individually?

Generally, only the parent company (group) must report under the CSRD. However, it will still need to collect sustainability data from subsidiaries to complete its consolidated report. Subsidiaries may therefore need to provide data internally, even if not directly in scope.

12. How does the CSDDD align with CSRD in terms of supply chain coverage?

The CSDDD is expected to limit due diligence to tier-1 suppliers, while the CSRD continues to cover the entire value chain. Companies will still be expected to report on impacts and risks across their full chain of activities, not just direct suppliers.

13. What about EU Taxonomy alignment for Wave 2 companies?

EU Taxonomy reporting remains mandatory for companies that stay in scope. The Omnibus changes do not alter the underlying Taxonomy requirements, though the timing and proportionality of disclosures may adapt to the new CSRD phase-in.

14. What do you recommend for companies that are now out of scope?

Even if formally excluded, larger companies should continue to use the ESRS framework as their reporting reference. It offers greater credibility and aligns with partner and investor expectations. The VSME can be helpful for smaller entities, but it may not meet larger stakeholders’ needs, and will need to be supplemented with sector-specific data.

15. Will there still be a “trickle-down” effect for smaller companies?

Yes, and it is already happening. Larger CSRD-reporting companies and banks will increasingly request sustainability data from smaller suppliers and borrowers. This market pressure will drive many SMEs to adopt CSRD-inspired or VSME-based reporting voluntarily.

16. When can we expect auditor guidelines for CSRD assurance?

The European Commission is expected to issue auditor and assurance guidelines by the end of 2026. These will clarify the role of both financial and non-financial auditors and harmonize assurance practices across member states.

Watch the full webinar replay

If you missed the live session “The Omnibus process and how it affects your reporting now” or want to revisit key insights, you can access the on-demand webinar recording below.

Access webinar

Julia Staunig

Chief Growth Officer

Position Green