Sustainable investments

From due diligence to exit

Our team of sustainability advisors help you throughout the sustainable investment cycle – from due diligence to exit. By staying one step ahead of evolving regulatory and market expectations, we support you in building strategies to reduce investment risk and drive overall impact.

Make sustainable investment decisions

Our team of sustainability consultants help you analyse, quantify and understand sustainability impacts to reduce risks and maximise opportunities in any investment decision. We stand by your side during the whole investment journey, from initial screening and dure diligence to holding period and exit. By using ESG insights and expert guidance you will be able to build robust investment strategies that stretches from compliance to value creation.

Sustainable investments services

Sustainable Finance Disclosure Regulation (SFDR)

M&A and ESG DD

EU Taxonomy

Investor strategy & governance frameworks

ESG-linked financing

Your advisors in Sustainable investments

Tony Christensen

Director

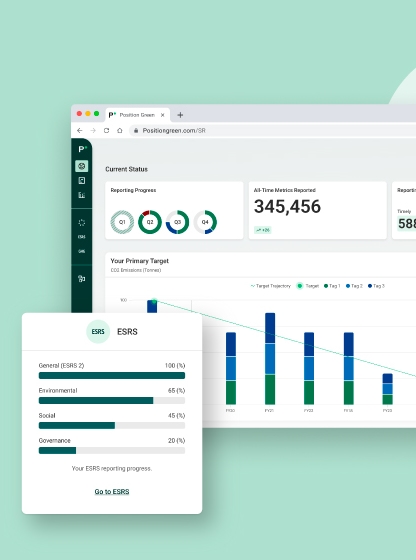

Position Green

Anders Klinkby

Director

Position Green

Philip Gustafsson

Manager

Position Green

Erin Knowles

Senior Manager

Position Green

How can our sustainability advisors help you?

Please share your contact details and we will be in touch shortly.

Strategic sustainability expertise

Sustainable business transformation

Turn compliance into strategic advantage