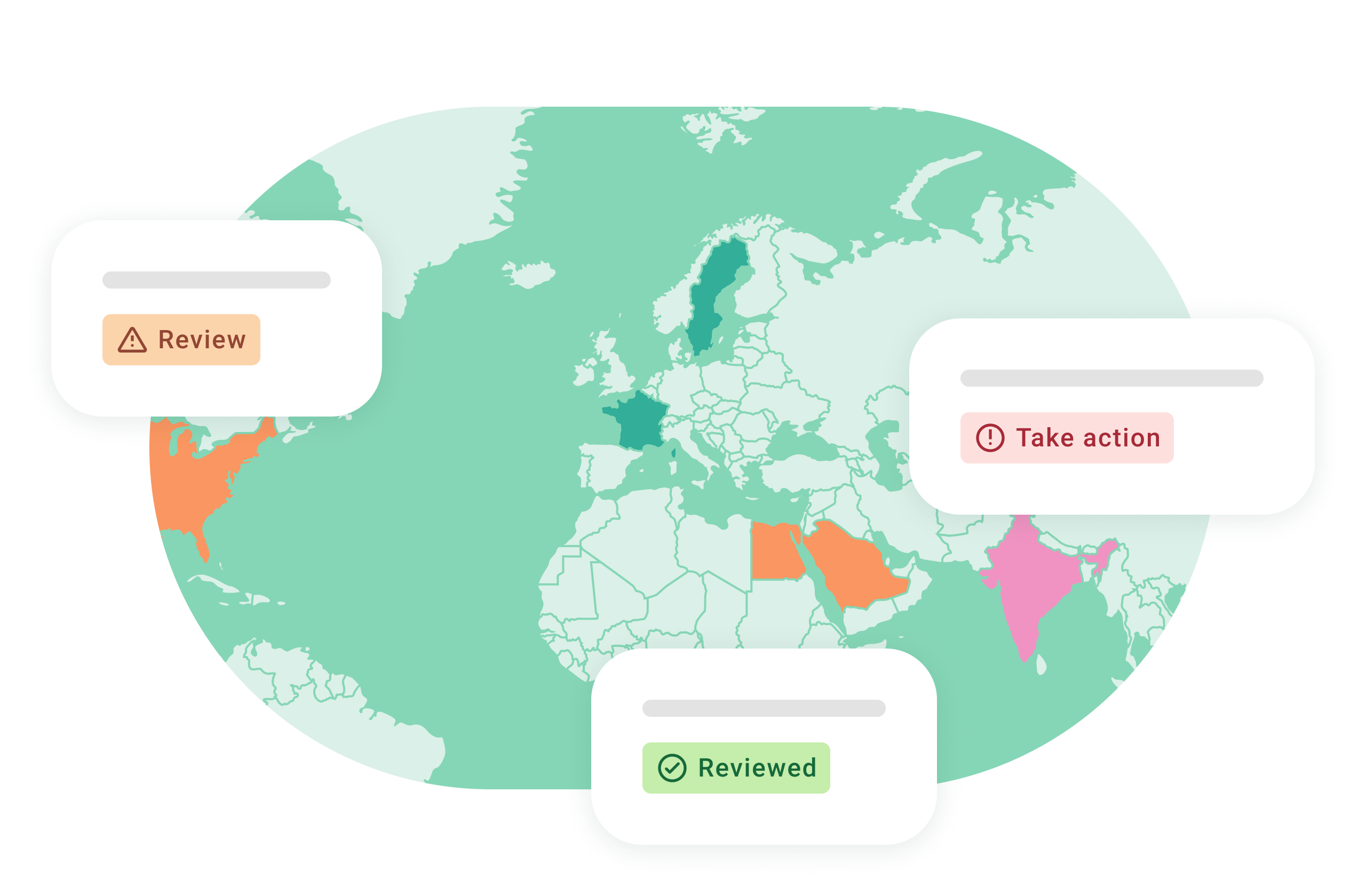

“Capital markets are central to Europe’s green transition, and that requires reliable data and transparent reporting. This partnership marks an important step toward building a more integrated ESG ecosystem in Europe”

Nils Jean-Mairet – Chief Financial Officer, Euroclear