Understanding ESRS and CSRD for US companies

The EU’s Corporate Sustainability Reporting Directive (CSRD) is a directive mandating companies to both report on and audit their Environmental, Social, and Governance (ESG) impact, ensuring transparency in their sustainability practices and performance. Under the CSRD, the European Sustainability Reporting Standards (ESRS) provide specific guidelines on how a company demonstrates their financial and impact materiality.

Who does it affect?

US companies with a substantial presence in the EU—through subsidiaries, significant revenue generation, or as part of the supply chain for EU-regulated businesses—will need to align with the ESRS. This includes entities in sectors ranging from manufacturing to financial services, all of whom will need to report on a wide array of sustainability criteria, encompassing environmental, social, and governance aspects.

US-based companies with significant business activities in the EU will need to publish sustainability information that encompasses their entire operations. Such companies may be obligated to comply with the CSRD if they fall into the following categories

- They are listed on a regulated market in the EU.

- They have an annual revenue in the EU exceeding €150 million.

- They possess an EU subsidiary that qualifies as a large company, meeting at least two of the following criteria:

- Having over 250 employees based in the EU.

- Generating local revenue of more than €50 million in net sales.

- Possessing a balance sheet total exceeding €25 million.

US-based companies that could be affected by the CSRD and are not currently treating their sustainability reporting with the same level of rigor as their financial reporting should promptly begin doing so.

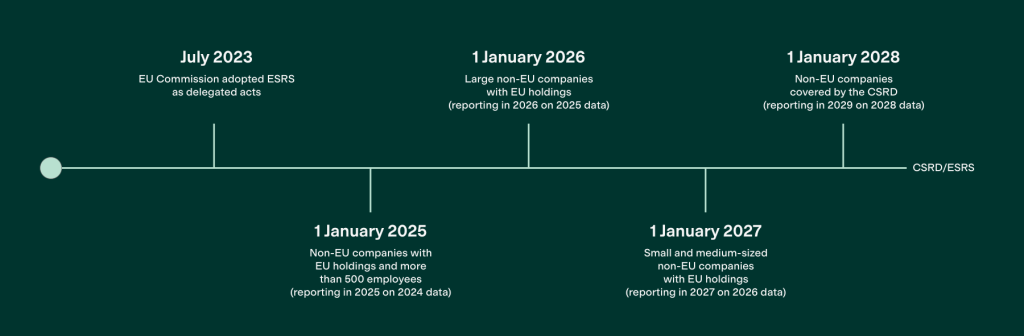

Timelines for US companies

CSRD mandates will be phased in from 2024, affecting companies based on their size, nature, and extent of operations within the EU. For US businesses, the key to preparation lies in understanding these timelines and the specific reporting obligations that will apply to their operations. With phased implementation, starting with large companies and gradually encompassing smaller enterprises, staying ahead of these regulatory timelines is crucial.

Why should US companies act now?

Waiting until the deadline may seem like a viable strategy, but it overlooks the complexities involved in aligning business processes with ESRS requirements. Early action allows companies to:

- Ensure compliance: Adequate preparation time is essential for understanding the ESRS framework and integrating it into existing reporting mechanisms

- Mitigate risks: Proactively adapting to ESRS reduces the risk of non-compliance, which can lead to regulatory penalties and reputational damage.

- Leverage strategic insights: Early engagement with ESRS criteria offers insights into sustainability trends and regulatory expectations, informing strategic decision-making.

What are the benefits to early reporting?

For US companies not directly subject to the ESRS mandates, voluntary alignment with the ESRS offers several advantages:

- Enhanced transparency and trust: Voluntary reporting signals commitment to sustainability, enhancing stakeholder trust.

- Investor confidence: With investors increasingly focused on ESG criteria, aligning with global standards like the ESRS can attract and retain investment.

- Market competitiveness: Demonstrating sustainability credentials can differentiate US companies in a crowded market, particularly in sectors where consumers prioritize ethical and environmental considerations.