Tackling transparency to fuel net zero goals

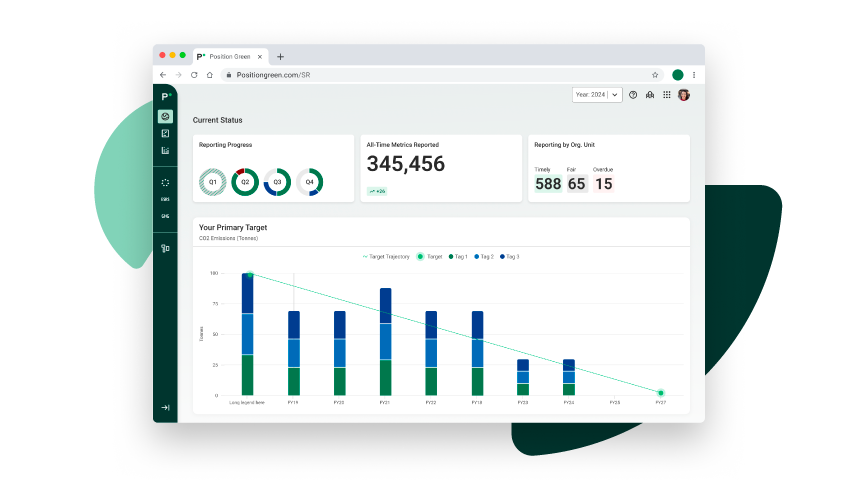

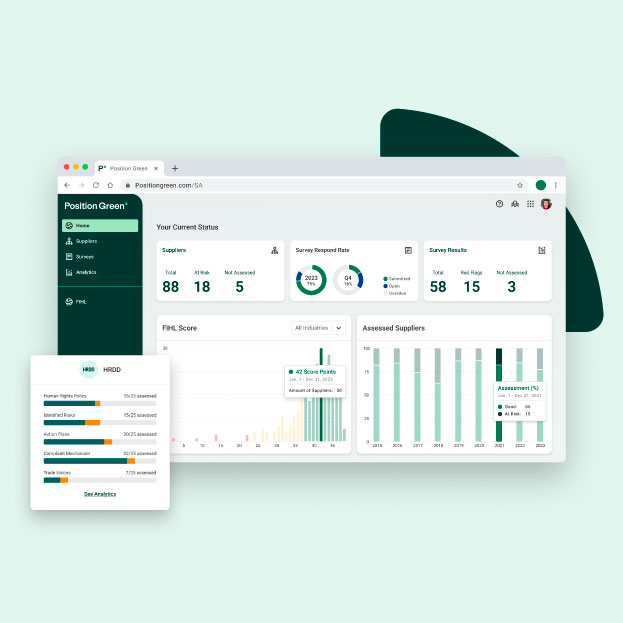

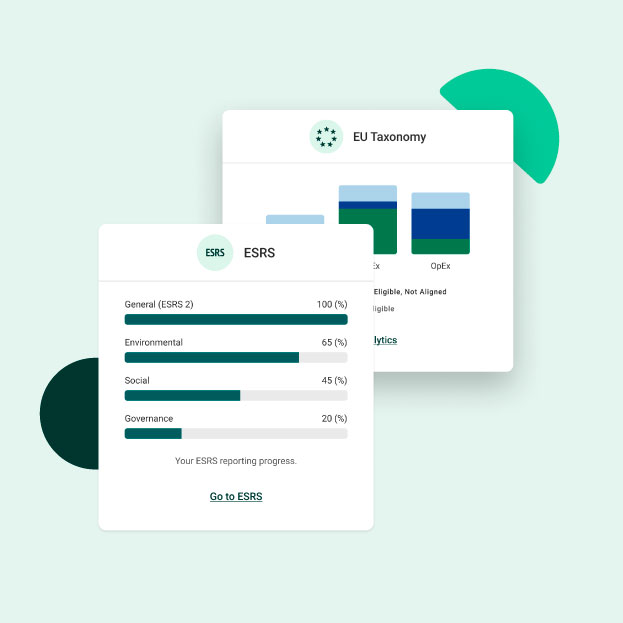

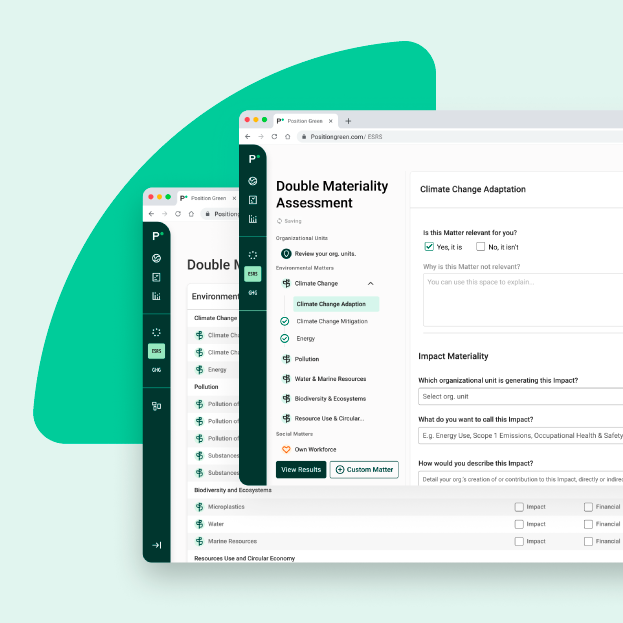

Position Green combines ESG software and advisory to help real estate players navigate the inherent risks and opportunities of ESG and accelerate their sustainability journey. Ensuring data integrity and consistency across properties and portfolios is critical for transparent ESG reporting, effective decision-making, global benchmarking (GRESB) and ESG performance assessment.

Driven by investor and regulatory demands and a considerable carbon footprint, the real estate sector has been one of the early adopters of ESG. However, ESG data management presents a complex challenge as real estate companies wrestle with an array of data sources, integration issues and stakeholder requirements. This is underpinned by the growing scrutiny of environmental and social impacts by investors, tenants and other stakeholders.