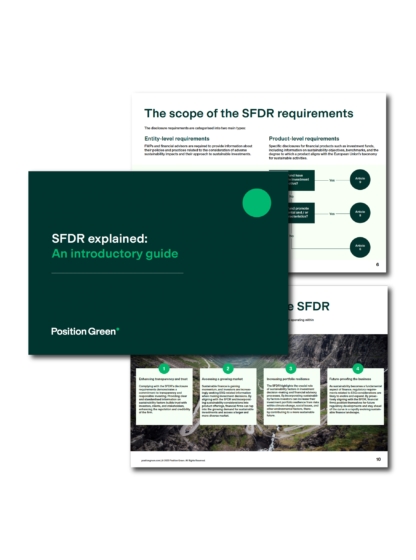

The SFDR impacts a wide range of financial market participants (FMPs) such as asset managers, investment funds, pension funds, insurance companies, banks and credit institutions.

The regulation imposes mandatory ESG disclosure obligations that compel these FMTs to report on the principal adverse impacts (PAIs) of their portfolios. The PAI indicators are a set of mandatory indicators and metrics which aim to show investors the potentially negative impacts certain investments may have on sustainability factors. Under these new requirements, fund managers, financial advisors and other financial institutions will need to collect ESG data and disclose any sustainability risks relating to their investments and financial products – on websites, in prospectuses and in periodic reports.